Asset-Based Lending

Conquer common challenges with dynamic ABL technology

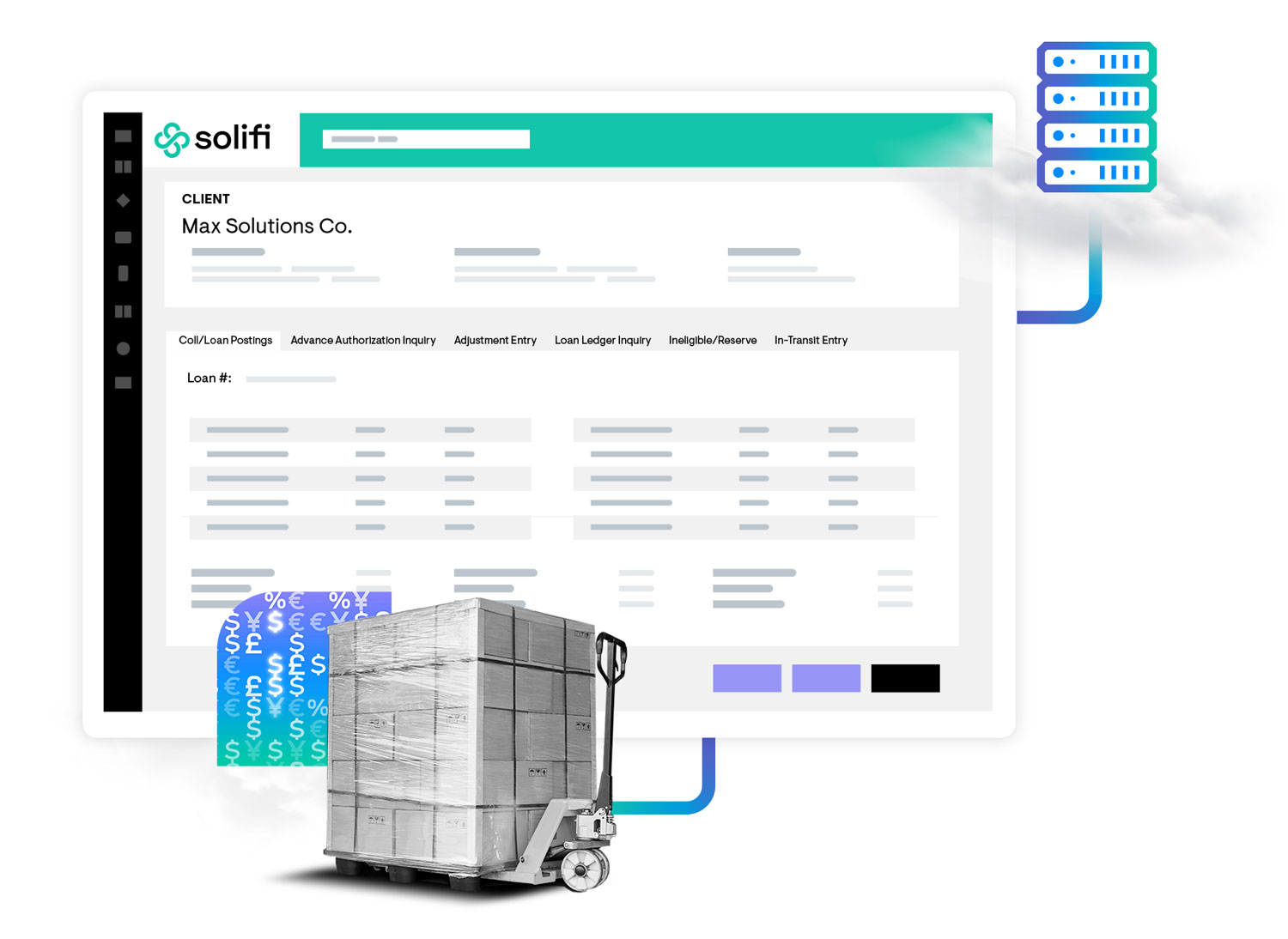

Do you spend a lot of time answering yes-no or closed questions that borrowers could resolve faster online? Is there a pressing need in your business for a more reliable way to leverage data in decisioning? These are just two of the top challenges facing ABL lenders today. Our software mitigates the risk of fraud, connects disparate systems, offers self-service, and lets you access data how and when you need it.

Embrace data insights and optimize your efficiency

Embrace a digital-first approach to take on your ABL challenges and emerge triumphant. Our ABL software (formerly Stucky ABL) provides you with powerful dashboards for tracking trends and analyzing portfolio data insights. Sophisticated algorithms identify irregularities within critical data sets, while accounts receivable automation tools allow your analysts to import monthly aging reports from borrowers and instantly calculates ineligibles.

Embrace data insights and optimize your efficiency

Embrace a digital-first approach to take on your ABL challenges and emerge triumphant. Our ABL software (formerly Stucky ABL) provides you with powerful dashboards for tracking trends and analyzing portfolio data insights. Sophisticated algorithms identify irregularities within critical data sets, while accounts receivable automation tools allow your analysts to import monthly aging reports from borrowers and instantly calculates ineligibles.

Eliminate low-value touches with 24/7 self-service

Today’s borrowers expect immediate access to their information online. Our borrower portal – available as a desktop or mobile application – lets your customers view both current and historical information, submit funding requests, post updates, and attach supporting documentation. That frees up time for your staff to focus on non-routine tasks and requests.

Eliminate low-value touches with 24/7 self-service

Today’s borrowers expect immediate access to their information online. Our borrower portal – available as a desktop or mobile application – lets your customers view both current and historical information, submit funding requests, post updates, and attach supporting documentation. That frees up time for your staff to focus on non-routine tasks and requests.

Key Features

- Borrower portal

- Diverse product partner ecosystem

Connect disparate systems and mitigate the risk of fraud through seamless integration with our partner APIs – including Experian, RiskFactor, DocuSign, Equifax, and more

- Data-streaming

- AR Wizard

- Availability calculations

Automate a range of complex calculations, including collateral values, ineligibles, advance rates, loan balances, and line limits and sub-limits

- Daily management reporting

- Trend reporting

- Custom branding options

Brand the borrower portal with your company’s logo and color scheme to extend your marketing footprint

- Invoice discounting

Deploy capital that earns interest and fee income. Generate a new revenue stream, reduce operating expenses, and expedite turnaround time for funding

- Automated calculations

Ready to unleash your potential?

Contact us to arrange a demo, answer questions, and talk about how Solifi Asset-Based Lending can help guard, guide, and grow your business.

"*" indicates required fields