ORIGINATIONS

Powerful loan origination technology

Is your ideal a loan origination process that cultivates customer journeys and automates manual tasks for your team? Are you the type of lender that’s pulled toward a product that does more for your customers, too?

Create a better financing experience for your customers and grow your business with the support of our software-as-a-service (SaaS) lease and loan origination software (formerly known as Rapport and CALMS).

Accelerate and automate your loan origination process

Solifi Originations automates and optimizes your entire workflow from the first customer interaction through quoting, credit decisioning, and documentation. With immediate access to your data, you can assess, report, and react quickly to mitigate risks, conduct audits, and enhance the customer onboarding experience.

Lease and loan origination for automotive finance

Today’s connected consumers expect speed, simplicity, and easy access. With a digital-first mindset, our originations software seamlessly integrates with a diverse ecosystem of product partners, using pre-built API-based technologies to enrich your data. Our technology places the power of information in your hands, helping you to make smarter and faster decisions.

Key Features

- Point-of-Sale

Powerful, easy-to-use digital tools for your loan application service to help you capture information and deliver accurate quotations

- Automated decision-making

- Risk management automation

Gather in-depth insights from integrated APIs and effortlessly implement risk-based pricing and finance capabilities

- Optimized workflows

- Digital processing

- Built-in data safeguarding

Compliance and audit automation

- Customizable functionality

Tailor your line of business requirements, support varied workflows, and define precisely which processes you want to automate

- Business-in-a-box

Boost your speed to market and simplify business processes by incorporating existing lending functions into a single, streamlined platform

- Integrated APIs

Lease and loan origination for equipment finance

From the first interaction with a new customer, you can reduce risk and improve customer service levels. Our software accelerates the application process all the way through quoting, credit decisioning, and documentation. Automate your deal flows and be rewarded with exceptional data transparency and auditability.

Key Features

- Deal flow management

- Custom pricing rules

- Anywhere, anytime access

- Credit bureau integration

- Digital processing

- Workflow management

Lease and loan origination for consumer finance

From the first interaction with a new retail consumer finance customer, you need to manage risk, enter, and access data quickly, and promote positive, personalized experiences. Our lease and loan origination software for consumer finance helps you protect and grow your business while providing a new level of customer service.

Key Features

- Digital identification

Ensure you’re dealing with the correct customer, reduce the need for customers to provide proof documents, and ensure compliance and audit trails using our trusted service providers’ e-ID capabilities.

- Streamlined customer applications

Give customers the freedom to arrange their own finance options with the secure self-service Customer Direct portal. Using multi-channel integrations, you can reduce manual processes and use digital processing for customer data, credit scoring, and analytics.

- Point-of-Sale

Powerful, easy-to-use digital tools for your loan application service help you capture information and deliver accurate quotations.

- Open banking functionality

Optimize market potential and effectively manage risk with a complete picture of an applicant’s financial affordability

- Automated decision-making

Drive rapid credit decisions in real-time with automatic scoring, debt calculation processes, and automated approvals and declines for routine applications increasing loan applications

- Optimized workflows

Make verification and underwriting processes faster and easier using pre-built integrations for third-party services

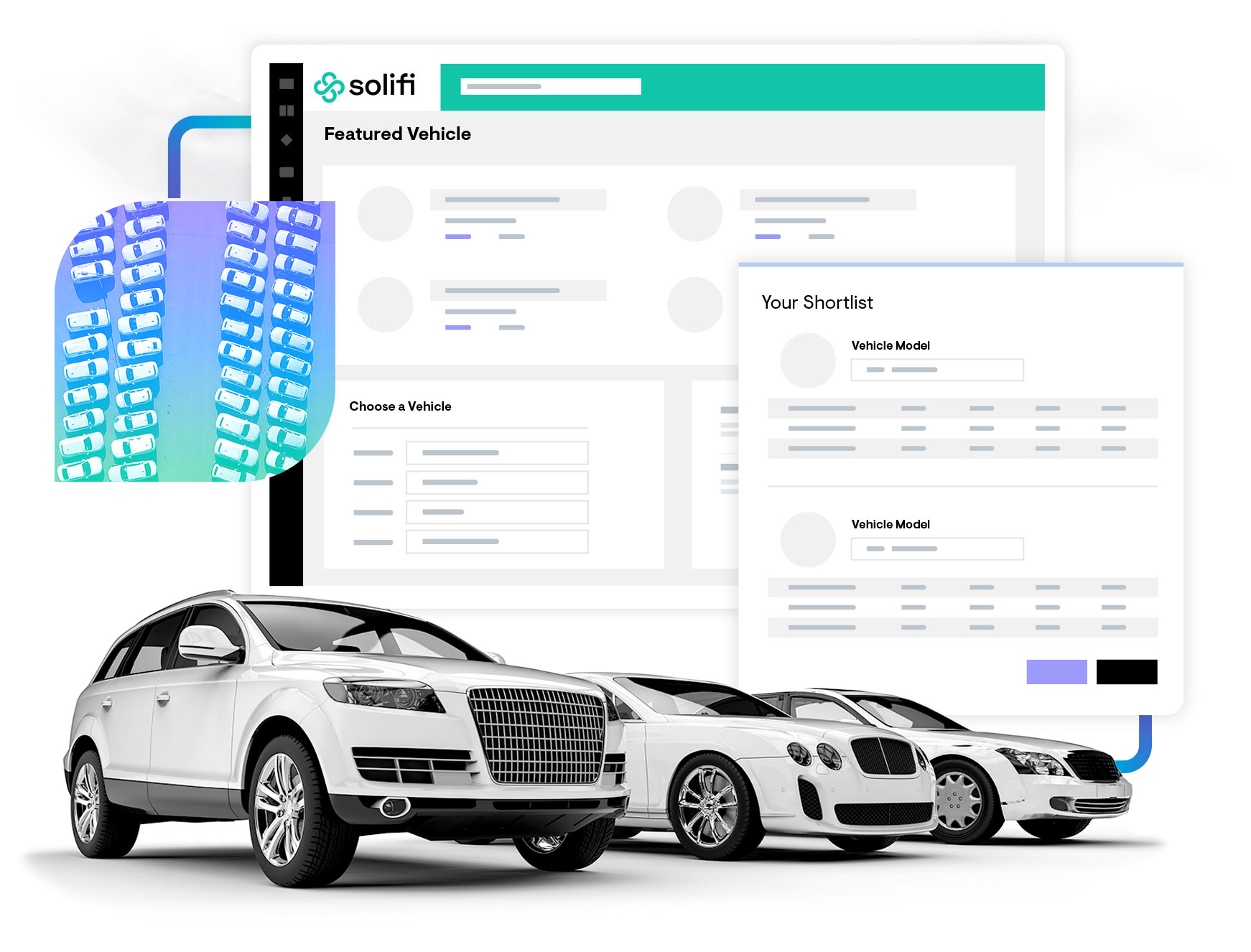

Lease and loan origination for fleet finance

Our software integrates seamlessly with your existing corporate fleet finance system to give you greater data transparency during the origination process and beyond. Support your fleet finance credit lines, oversee profitability, and improve organizational processes with minimal internal resource involvement – all while giving your fleet finance customers a smooth onboarding journey.

Key Features

- Vehicle locator

Complete searches in a preferred dealer network, covering all franchised dealers, manufacturers, funders, or special offer vehicle inventory

- Risk management automation

Manage your exact credit requirements, including credit reference agency searches, flexible underwriting, and credit analysis support. Gather in-depth insights from integrated APIs and implement risk-based pricing and finance capabilities effortlessly

- Self-service portal

Provide fleet business users self-service access to functions such as fleet quotations and configurations, driver-specific quotes, vehicle location, ordering, and order tracking

- Order management

Save time by seamlessly managing the creation of orders and tracking their progress where multiple suppliers are involved, as well as supplier capture and verification, order placement, bulk orders, order tracking, and contract activation

- Configurable workflows

Make work queues, verifications, underwriting, and tracking faster and easier using pre-built integrations

- Full quotation capability

Allow complex, multi-vehicle configurations and quotations for fleet managers or public users, including product and VAP variations, RV and SMR adjustments, and other discount agreements

- Rapid implementation

Out-of-the box, standard configurations to fit your needs and increase value

- Built-in data safeguarding

Compliance and audit automation – including a calculation engine with tax compliance and real-time auditing and management reporting

- Digital processing

Enable agreement and document signatures from anywhere to streamline experiences, speed up administration, and reduce costs without sacrificing security

Ready to unleash your potential?

Contact us to arrange a demo, answer questions, and talk about how Solifi Originations can help guard, guide, and grow your business.

"*" indicates required fields