Factoring

Boost data insights and exceed your targets

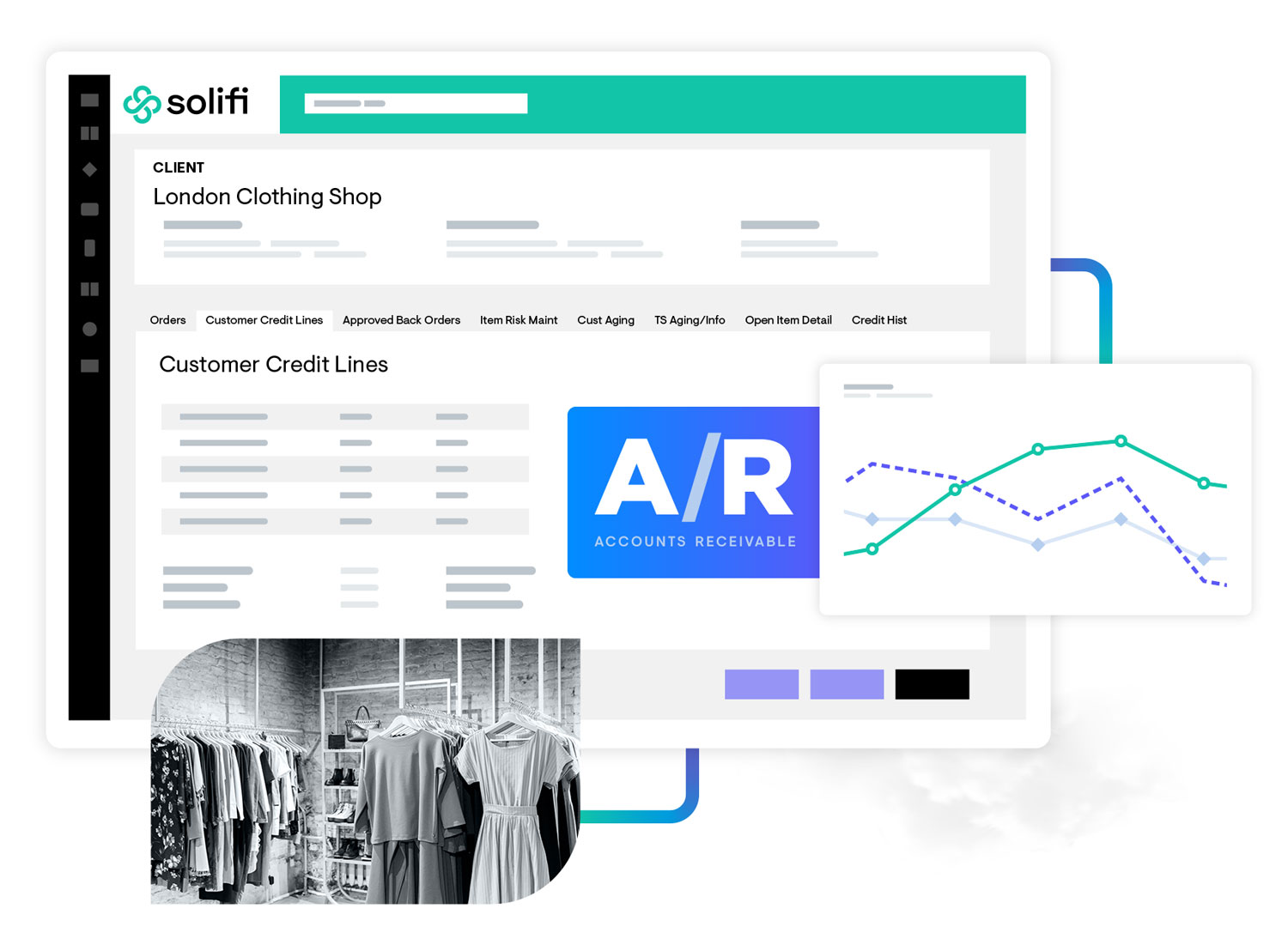

Looking for ways to gain insights, mitigate risk, and maximize margins? Solifi Factoring, built on advanced algorithms, forecasts the credit risk of your accounts receivable portfolio and makes it easier to monitor risk and mitigate losses due to debtor issues, such as bankruptcy.

Combat uncertainty, risk, and unpredictability

Agile technology helps you to anticipate and react to ever-evolving business disruption. Growing your factoring portfolio requires a software solution that gives your customers fast access to cash, streamlines approval processes, and provides competitive rates. Our software provides the power and flexibility you need to mitigate risk and grow your recourse and non-recourse factoring portfolios.

Empower your factoring clients with 24/7 self-service

Our powerful online factoring portal makes it easy to post invoices, submit credit requests, retrieve reports, track customer payment status, and verify customer credit limits.

Key Features

- Interoperable system

Easily create and maintain a range of factoring products, services, and add-ons

- Comprehensive access control

- In-depth analytics

- Automated alerts

- Workflow management

- Custom branding options

Brand the client portal with your company’s logo and color scheme to extend your marketing footprint

- Complex proposal management

Provide line-of-credit and collateral management for several types of assets, helping clients offer and manage complex working capital proposals

Ready to unleash your potential?

Contact us to arrange a demo, answer questions, and talk about how Solifi Factoring can help guard, guide, and grow your business.

"*" indicates required fields