Wholesale finance

Wholesale finance technology without limits

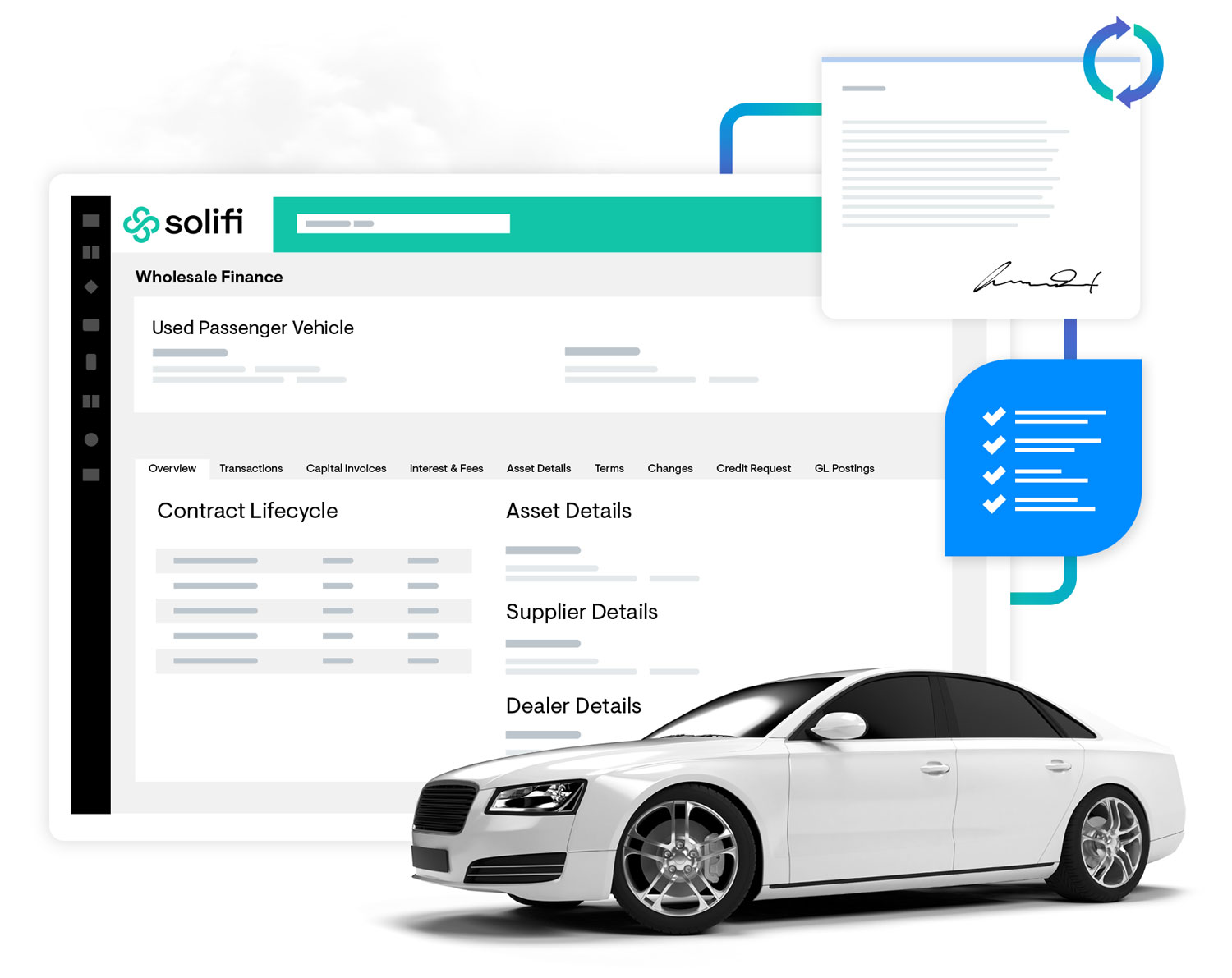

Welcome to universal wholesale finance software – whatever your asset. Automate your wholesale finance processes, eliminate errors, and engage your dealers with our next-generation platform. Looking to simplify customer invoicing and communications? Our technology provides you with a dealer-intuitive, self-service approach that’s scalable right out of the box.

Oversee productivity, planning, and portfolios

With a complete view of your wholesale finance business from the portfolio level to the individual dealer, Solifi Wholesale Finance allows you to monitor team and individual portfolio manager metrics. It’s also highly configurable – and will help wrap up your most labor-intensive tasks with smart automation.

Total supply chain visibility

Solifi Wholesale Finance offers true supply chain integration, giving you visibility over companies, customers, and partners from factory to dealer. It also includes customer self-service capabilities – meaning your dealers and suppliers are empowered to run their own portfolios.

Key Features

- Credit underwriting

- Risk management

Set credit lines, sub-limits, and seasonal uplifts that reflect your policies and risk levels, while configurable rules allow a seamless flow of goods between supplier and dealer

- Accounting controls

- Customer self-service

Put the dealer and supplier in control around the clock to improve efficiency. From loan onboarding to payments and dealer trades, let our portal cut back on the time taken on manual tasks

- Integrated stock auditing

Seamless integration with all major inventory audit providers and our audit dashboard allows for flexible audits by lender, dealer or third parties

- Web-enabled

Out-of-the-box functionality and a well-defined road map keep you up to date with a dynamic market – all with minimal infrastructure and up-front investment

- Scalable solution

The sky’s the limit. Acquire new portfolios, introduce new product lines, or implement new products and services without worrying about being held back by your system

Ready to unleash your potential?

Contact us to arrange a demo, answer questions, and talk about how Solifi Wholesale Finance can help guard, guide, and grow your business.

"*" indicates required fields