Pandemic. Inflation. Recession. Rising costs. Product shortages. Supply chain issues. Regulatory compliance. These challenges affect all industries – and secured finance is no exception.

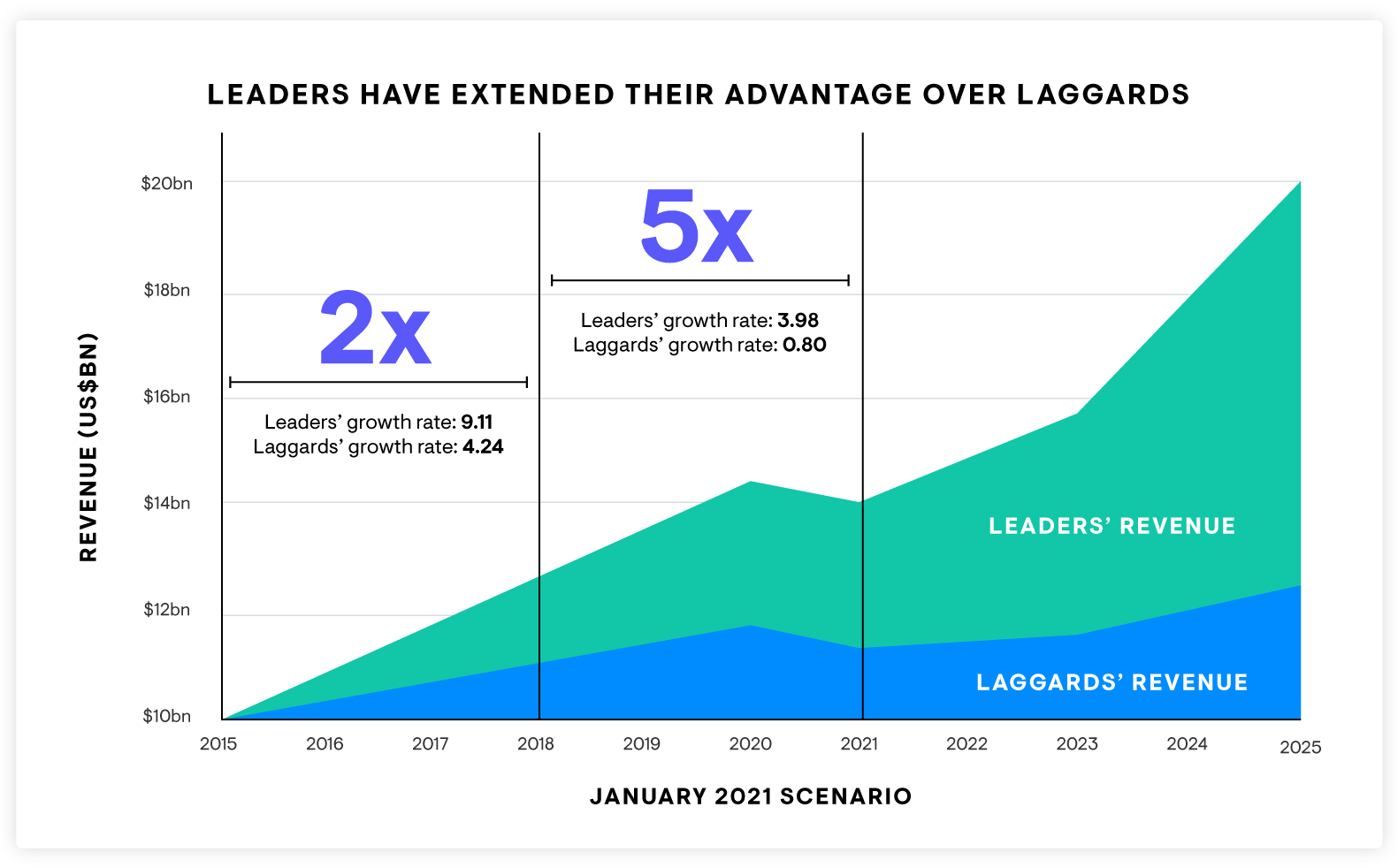

Forward-thinking secured finance business leaders know they must continue to grow through change and business disruption to remain competitive. A research study by Accenture found that before the pandemic, leaders in technology adoption and innovation were growing two times faster than those with an aversion to change. That rate increased to five times faster during the pandemic as these business leaders embraced innovative cloud-based technology such as artificial intelligence (AI) and machine learning to outperform their competitors.

In one of our recent surveys, nearly 42% of secured finance decision makers said that integrating new lending software technology into their operations over the next year – even with the possibility of a recession – is critical to their future success. And nearly 88% believe it is beneficial to invest in futureproof technologies during a recession (e.g., to reduce operating expenses by streamlining workflows and prepare for post-recession momentum).

88% of secured finance leaders say technology investment during a recession is beneficial

Top 5 recommendations to remain competitive with futureproof technologies

Market leaders understand that disruption should not limit their ability to adapt – and that technology can help transform challenges into opportunities. But where to start?

Here are the top five ways to accelerate your secured finance business with technology to quickly adjust to change as a result of business opportunities or external factors.

- Go digital

- Stick with standards

- Adopt evergreen IT

- Move to the cloud and software-as-a-service (SaaS) technology

- Harness data insights

We’ll start with going digital in part 1 of this five-part series.

Part 1: Go digital to futureproof your secured finance business with software technology

The first – and most obvious – step to futureproof your secured finance business with technology is to make a commitment to go digital. As we all know, digital transformation accelerated greatly in the secured finance industry over the past two years.

Many lenders that used paper and manual processes pre-pandemic were forced to go digital. And most have accepted digitization is here to stay. The path to post-pandemic success will rely on continued digital transformation. That’s because consumer and B2B behavior and expectations have changed. Implementing the right finance lending software is a great start.

Post-pandemic digital transformation opportunities

Here are several potential post-pandemic opportunities in a digital world.

Rethink the workforce and your organization

Remote work is profitable and productive for most organizations. Rethink long-held beliefs about workspace and worker enablement as you embrace digital transformation for your secured finance business.

Rebuild and revitalize secured finance operations

The pandemic magnified the importance of flexibility, scalability, resilience, and integration. Ditch the spreadsheet and adopt automated workflows provided by innovative finance lending software technology.

Accelerate digital transformation with futureproof technologies

Digital transformation, such as moving to the cloud or SaaS, accelerated during the pandemic and ignited a greater need for increased access to data. Omnichannel connections, reimagined supply chains, and all things digital are moving to center stage.

Conserve capital while investing in finance lending software technology

Going digital can help business leaders find a balance between conserving capital and investing enough in technology to grow and remain competitive. Partner with a fintech provider, like Solifi, who can guard, guide, and grow your business through disruption by offering innovative finance lending software.

Want to learn more?

While secured finance lenders possess various levels of digital maturity, we’re still seeing opportunities where organizations could benefit from automated technology and innovative finance lending software, for example. Going digital optimizes workflows, mitigates risk, saves time and money, and enhances the customer experience.

Contact one of our experienced secured finance solutions consultants to learn how you can futureproof your business with software-as-a-service (SaaS) technology and an open finance platform.

Like this blog post? Please save and share on your social networks

So many opportunities exist to accelerate your secured finance business with technology. Regardless of your size or where you are on your digital transformation journey, keep these top five recommendations in mind when futureproofing your business with technology.

Top 5 ways to futureproof your business with technology

Read Part 1: Go digital

Read Part 2: Stick with standards

Read Part 3: Adopt evergreen IT

Read Part 4: Move to the cloud and SaaS

Read Part 5: Harness data insights

What is…?

Cloud: Essentially storage of data, software, and services on virtual servers located in data centers all over the world.

SaaS: Instead of users installing software on their computer, software-as-a-service (SaaS) applications are hosted on cloud servers and are accessed either through a browser or through an app.

Evergreen IT: Small iterative updates to IT systems and software so that business systems are always kept up to date.

Platform: The foundation of your business ecosystem. A set of software tools and a standard infrastructure that serves as a foundational service that can be leveraged to integrate other applications and services.